The smart debit card for kids

Help your kids feel financially independent with a GoHenry kids' prepaid debit card—it's a great way for them to learn the value of money

The kids’ debit card & app that grows with your kids

A GoHenry debit card and app is just like a regular kids' bank card—but way better. It teaches kids and teens how to be independent and smart with money by helping them track their spending, budgets, savings goals, and more—all with support and guidance from their parents.

Why choose a GoHenry kids’ debit card?

From getting to grips with the digital economy to making their first budget, there are tons of reasons why parents choose GoHenry as their kids' prepaid debit card. With pocket money on repeat, chores in the app, and flexible parental controls, GoHenry allows members to manage money responsibly—together.

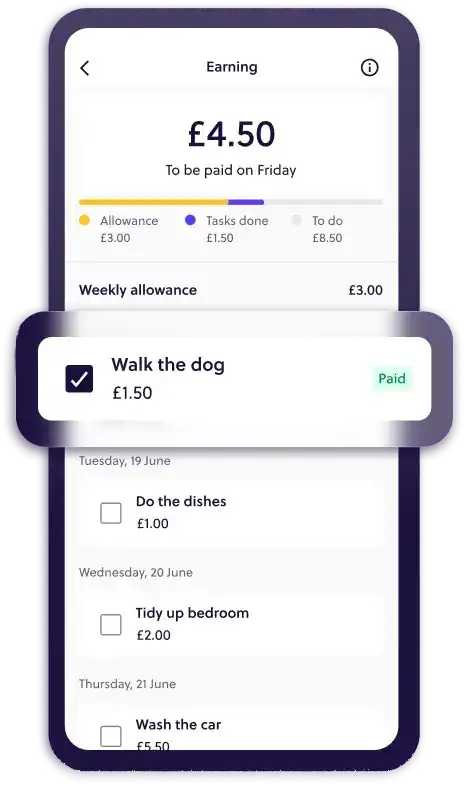

Automated pocket money

Weekly pocket money teaches kids how to budget, and that once the money’s gone, it’s gone

Incentivise chores

Set task lists and send rewards for completed chores to teach the value of earning

Unlock money skills

Kids learn money management and budgeting skills by tracking their own cash flow in-app

Hello independence!

Kids can use their card online, in person, and for gaming for more spending independence

Savings, stashed

Set customised savings goals in the app—and choose to lock them in to teach kids the power of saving

Get the answers

In-app money lessons help kids learn about wider money topics—so don’t be surprised if Buy Now Pay Later comes up at the dinner table!

Travel abroad fee-free

Bags, packed! Kids can head on holiday with fee-free transactions abroad

One app, two accounts!

Easily switch between parent and child accounts on a shared device, or download the GoHenry app to separate devices

A kids’ debit card built for their safety— and your confidence

- Zero Liability Policy by Visa

- Prepaid kid's debit card with no risk of debt or overdraft

- Real-time spending notifications

- GoHenry blocks unsafe spending categories

- Chip and PIN-protected transactions

- Secure PIN recovery in the app

- Bank-level encryption

- Reliable card replacement

- Easily block and unblock cards

Memberships and pricing

Choose from three GoHenry memberships and try 30 days for free.

Cancel or switch memberships anytime.

*Interest rate is variable. Additional terms and conditions will apply.

A pocket money card for kids

With GoHenry, paying pocket money is easy for you and fun for kids. Set an amount in the app, the day you want to pay and their pocket money arrives on their card weekly. Kids learn how to budget their money independently with cash on their card to spend, save or gift.

To help kids learn the power of earning, parents can set paid tasks in the app—as soon as kids tick them off they’ll automatically receive cash on their card. Want a bit more control? You also have the option to check tasks have been completed in-app before your child receives their pocket money.

How to get started with GoHenry

Ready to give GoHenry a try? Sign up for a free trial and get access to all GoHenry features free for 30 days. After your free trial, your monthly fee will start at £3.99 per month per child.

Follow these simple steps:

Sign up for your 1-month free trial in just a few minutes!

Kids can start learning instantly through Money Missions in their GoHenry app

Use your parent app to set up pocket money, tasks & top up your child’s card

Your customised card will arrive within one week, ready to go!