Invest in your child's future with a GoHenry Junior ISA

We all want our kids to succeed in the future. Whether that's university, exploring the world or buying their first home—a GoHenry Junior Stocks and Shares ISA is a great way to try to grow a pot of money for your child.

Tax treatment depends on your individual circumstances and may be subject to change.

You need to be a GoHenry member to open a Junior ISA

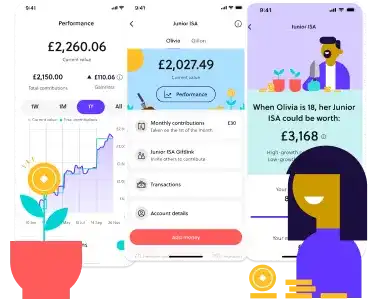

For illustrative purposes only. Projections are not a reliable indicator of future performance.

We take your lump sum, monthly contributions and child's age, and apply a 5% annual growth rate (8% for the higher projection and 2% for the lower)

As your kids build money skills, you're building their future

- Invest from as little as £1

- Your child's funds are managed in one place

- Contribute what you can afford each month

- Kids spend, save, earn, give and learn how to manage money with a prepaid debit card and app

- Stay in the know with regular updates

- Money is held for your child until they turn 18

Who can open a Junior ISA

A GoHenry Junior Stocks and Shares ISA can be opened by parents or guardians of kids under 16 who live in the UK.

A world of opportunity is waiting for your child—so let's get started

Join GoHenry with 1 month free—on us!

Open a Junior ISA with just £1

Contribute up to £9,000 tax-free in 2024-2025

Create a pot for when they turn 18

Tax treatment depends on an individual's circumstances and is subject to change.

92% of GoHenry members with a Junior ISA said they would recommend it to other parents

Survey of 511 GoHenry members with a Junior ISA in April 2022

Join for free* & start learning instantly

Prepaid debit card + in-app learning + Junior ISA

30 days free, then plans from £3.99 a month

Set up your card in minutes.

Cancel anytime.

*Fund fees apply. Junior ISA rules and terms and conditions apply.

Capital at risk. The value of your investment can go down as well as up. Tax treatment depends on an individual's circumstances and is subject to change.

Your questions, answered

A Junior ISA (Individual Savings Account) is a long-term and tax-efficient way to try to grow a pot of money for your child. Open the account with as little as £1, and the money will be held until your child’s 18th birthday. Plus, when investing in Junior Stocks and Shares ISA (JISA) for your child, the taxman won’t touch the returns from the investment – it’s free from income tax and capital gains tax, up to £9,000 per tax year (for the 2024-2025 tax year).

Your child can only have one cash and one Stocks & Shares Junior ISA. If you already have a Stocks & Shares Junior ISA you will need to transfer it to GoHenry before you contribute to your GoHenry Stocks & Shares Junior ISA.

If your child has a Child trust fund, this will need to be transferred to GoHenry before you contribute to your GoHenry Stocks & Shares Junior ISA.

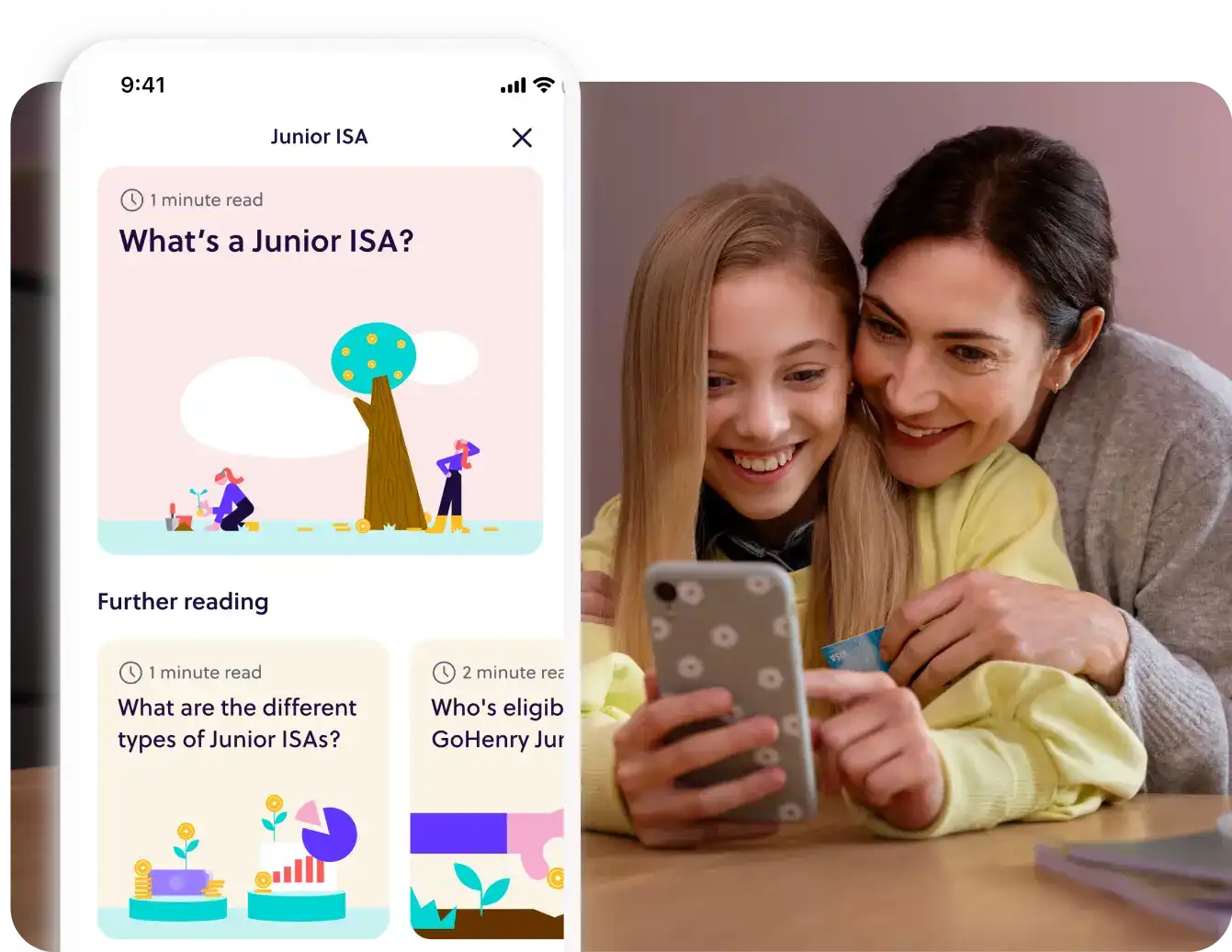

Learn more in the GoHenry app! Click here to read our article on the basics of a Junior ISA, or open your GoHenry app and tap 'Money', then 'Junior ISA'.

To set up a GoHenry Junior Stocks and Shares ISA, please log in to your app and select 'money', 'Junior ISA' to find out more and start your application. You’ll need to be the legal guardian of the child and a tax resident in the UK. Unfortunately, we cannot offer our Junior ISA to citizens of the United States.

Your money is invested with Vanguard (the fund Manager) in their Lifestrategy 60% equity fund, which is composed of stocks and bonds. Read more in the GoHenry app here.

There are two kinds of Junior ISAs: a Junior Cash ISA and a Junior Stocks and Shares ISA. Both come with tax benefits. Junior Cash ISAs earn interest while Junior Stocks and Shares ISAs offer capital growth and dividends.

Our Junior ISA is a Junior Stocks and Shares ISA, which means there is no associated interest rate.

While riskier than cash investments, stocks and shares investments are seen as a long-term venture. Patience is needed to ride through short-term market fluctuations and wait for potential profitable returns. But with more years in hand, investing may be better than a regular savings account. This is because, in the long run, the stock market tends to perform better, although past performance is not an indication of future results.

If you'd like to learn more about saving vs investing you can click here to find out more.

The value of your investment can go down as well as up.

Investments in our Junior Stocks and Shares ISA can rise and fall with the market. You can read this article to understand more about how investments can perform over the long term.

HMRC rules for cancelling a Junior ISA are strict. If you have any questions about cancelling or stopping contributions, please contact our dedicated team at support.investments@gohenry.co.uk.

Please check out our article on transfers, including how to find an existing Child Trust fund. We prefer to receive Junior ISA transfer forms electronically. Please email them to transfer.investments@gohenry.co.uk. If required, paper forms can be sent to GoHenry Member Services, Spectrum Point, 279 Farnborough Road, Farnborough, GU14 7LS. Posted forms will result in longer response times. If you have any further questions, our dedicated team can assist. Please contact support.investments@gohenry.co.uk.

Seccl Custody Limited act as the Junior ISA manager. To learn more please see our GoHenry Investment Services terms and conditions here or contact our dedicated team support.investments@gohenry.co.uk for any questions.