Money skills: unlocked

Start your child’s money journey with GoHenry

52,000+ 5 star reviews on Trustpilot and the App Store and Google Play Store worldwide

GoHenry benefits

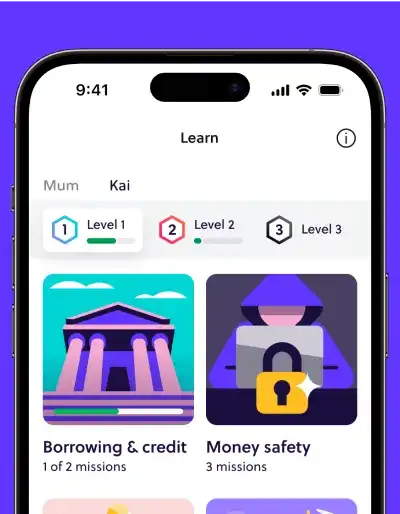

Gamified money lessons

Boost financial earning with educational videos and quizzes that teach real-life money skills

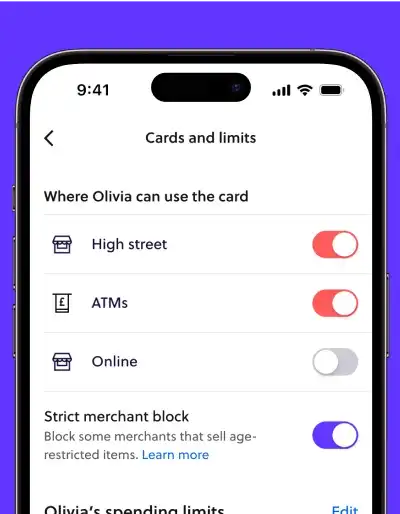

Smart parental controls

Spending limits help you choose when and where they use their card

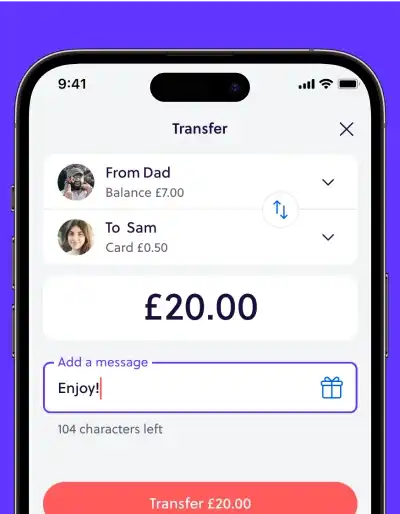

Instant transfers

Send money to your child’s card for need-it-now moments or a special treat

Watch and guide

Get notifications when your child spends and help them budget with in-app spend mapping

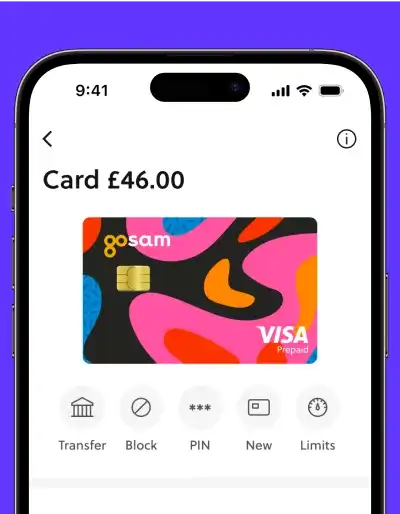

Hello independence

A new sense of independence with their own account and card

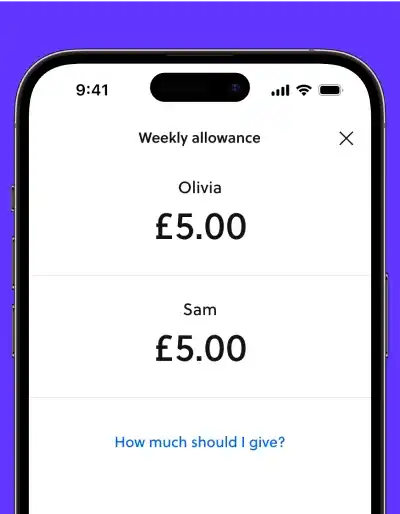

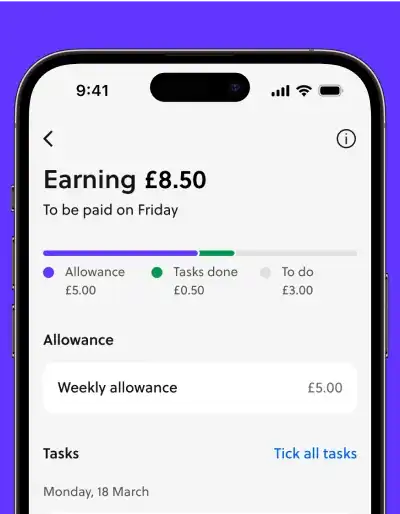

Pocket money made easy

Boost your child’s budget by sending pocket money automatically

Kids learn to earn

Set tasks in-app—your child can earn some extra pocket money

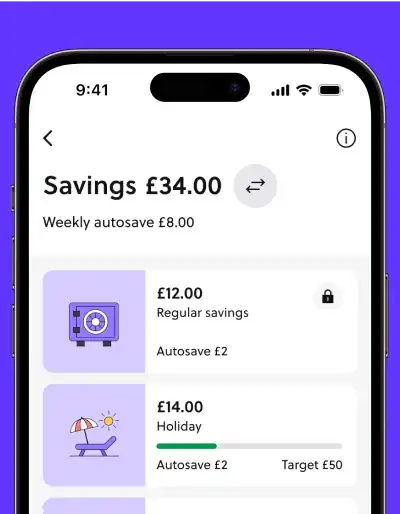

Savings…secured

Kids can set customised savings goals, which you can lock and unlock in-app

Memberships and pricing

Choose from three GoHenry memberships and try 30 days for free.

Cancel or switch memberships anytime.

*Interest rate is variable. Additional terms and conditions will apply.

How to get started with GoHenry

Ready to give GoHenry a try? Follow these simple steps:

Sign up for your 1-month free trial in just a few minutes!

Kids can start learning instantly through Money Missions in their GoHenry app

Use your parent app to set up pocket money, tasks & top up your child’s card

Your customised card will arrive within one week, ready to go!

Frequently asked questions

My child’s GoHenry card has been lost. How do I replace it?

You can block a lost card instantly in the GoHenry app, then unblock it once it’s found. If the card doesn’t turn up, let GoHenry know as soon as you can, then order a replacement for free in your parent app.

Can two parents have access to the GoHenry account

Yes! You can add a co-parent to your account using your parent app. Co-parents can help manage your child’s account, receive spend notifications, and add money to the parent balance using the registered card.

What kind of transactions do you block?

GoHenry blocks transactions at gambling, tobacco, and other adult-only merchants and online sites. You can also enable ‘strict merchant block’ which prevents your child from making any purchases in places that sell age-restricted items.

How does my child log in to the GoHenry app?

You’ll find your child’s login details in your parent app—they’ll need them to log in to their app on their device. You can also use a family tablet to switch between accounts on the same device if they don’t have their own smartphone.

How does my child use the card at an ATM?

Your child can withdraw money at an ATM up to three times a day using their PIN (you’ll find this in your parent app). There is a daily withdrawal limit of £120, but you can lower this in your app.

Is there a limit to how much my child can spend on their card?

GoHenry has a default spend limit of £60 per week and £30 per single spend, but you can set your own limits when you activate your child’s card. Limits can be changed anytime in your parent app, up to a maximum daily spend limit of £4,000.

How do I transfer funds from my child’s account back to my parent account?

You can instantly transfer funds back to your account in your parent app. Click ‘Transfer’ on the home screen and select the option to move funds from your child to you. Then enter the amount you want to send and press 'Transfer'.

Can I use GoHenry abroad?

Your child can use their GoHenry card abroad fee-free! Make sure they pay in local currency rather than GBP to avoid extra fees.